Calendar Year 2010 W-2 Form |

|

January 25, 2011,

Volume 57, No. 19

|

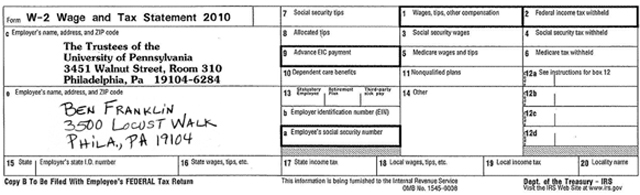

The University has recently mailed over 33,000 Calendar Year (CY) 2010 W-2 Forms to employees’ permanent addresses as they appear on the Payroll File (Employee Database). If the permanent address was not completed on the Payroll file, the W2 Form was mailed to the current address. An explanation of the contents of the various boxes on the W-2 form is as follows:

Box 1. Wages, tips, other compensation: Represents the total amount of Federal Taxable compensation paid or imputed to you during Calendar Year 2010 through the University Payroll System. This amount includes:

a. The value of your taxable graduate and/or professional tuition benefits, if you, your spouse and/or your dependent children have received such benefits;

b. The value of Group Life Insurance coverage for amounts greater than $50,000.

Amounts that are excluded from this amount are:

c. Tax deferred annuity contributions (i.e., TIAA/CREF);

d. Health, Dental and Vision Care insurance premiums that have been sheltered;

e. Amounts voluntarily contributed to a dependent care or a medical reimbursement account;

f. Parking, Transit Checks, TransPass and Van Pool premiums that have been sheltered.

Box 2. Federal income tax withheld: Represents the amount of Federal Income tax which was withheld from your earnings during the year and paid to the Internal Revenue Service, on your behalf, by the University.

Box 3. Social Security wages: Represents the total amount of compensation paid to you during Calendar Year 2010 which was subject to Social Security (FICA/OASDI) tax, excluding applicable shelters and including all of your tax deferred annuity contributions and excess life insurance premiums.

Box 4. Social Security tax withheld: Represents the total amount of Social Security (FICA/OASDI) tax which was withheld from your earnings during the year and paid to the Social Security Administration, on your behalf, by the University.

Box 5. Medicare wages and tips: Represents the total amount of compensation paid to you during Calendar Year 2010 which was subject to Medicare tax, excluding applicable shelters and including all of your tax deferred annuity contributions and excess life insurance premiums.

Box 6. Medicare tax withheld: Represents the total amount of Medicare tax which was withheld from your earnings during the year and paid to the Social Security Administration, on your behalf, by the University.

Box 9. Advance EIC Payment: Represents the total amount which was paid to you as advanced earned income credit (EIC) payments.

Box 10. Dependent care benefits: Represents the total amount which you have voluntarily “sheltered” for dependent care expenses, regardless of whether you have been reimbursed by the University for the expenses associated with this “shelter” as of December 31, 2010.

Box 12. Other:

Code C Taxable cost of group-term life insurance over $50,000: The Internal Revenue Service requires premiums paid by an employer for group life insurance coverage in excess of $50,000 must be imputed as income to the employee. The amount, which appears in Box 12 and labeled (C), is the value of the premiums paid for this excess insurance coverage. The amount is already included as part of your taxable wages in Boxes 1, 3, and 5. This amount is based on an Internal Revenue Service (IRS) table, which identifies premiums for different age groups.

Code E Elective deferrals under a section 403(B) salary reduction agreement: Represents the total amount of contributions made by an employee to a retirement plan on a tax-deferred basis.

Code G Elective deferrals and employer contributions (including non elective deferrals) to any governmental or non governmental section 457(b)deferred compensation plan

Code M Uncollected Social Security or RRTA tax on taxable cost of group-term life insurance over $50,000 (for former employees).

Code N Uncollected Medicare tax on taxable cost of group-term life insurance over $50,000 (for former employees).

Code P Excludable moving expense reimbursements paid directly to employee: Represents the nontaxable moving expenditures that were paid to you as a reimbursement. If any reimbursements or third party payments were deemed to be taxable income, you were notified of these amounts under separate cover.

Code T Adoption benefits (not included in box 1). You must complete IRS Form 8839, Qualified Adoption Expenses, to compute any taxable and nontaxable amounts.

Code Y Deferrals under a section 409A nonqualified deferred compensation plan: Represents current year deferrals under a section 409A nonqualified compensation plan.

Code Z Income under section 409A on a nonqualified deferred compensation plan. This amount is also included in box 1. It is subject to an additional 20% tax plus interest. See “Total Tax” in the Form 1040 instructions.

Code BB Designated Roth contributions under a section 403(b) plan.

Code CC HIRE ACT-exempt wages and tips. (For employer use only)

Box a. Employee’s social security number: This is the number which Federal and State Governments use to identify you with the tax returns that you file, so please review it for accuracy. If the number is incorrect, the University Payroll system is also inaccurate and you should contact the Payroll Office, immediately, before you file your returns.

Box 14. Other: SUT represents the amount of State Unemployment tax which was withheld from your earnings during the year.

Box 16. State wages, tips, etc.: Represents the total amount of compensation paid to you during Calendar Year 2010 which was subject to State Income Tax.

Box 17. State income tax: Represents the total amount of State Income Tax withheld during Calendar Year 2010.

Box 18. Local wages, tips, etc.: Represents the total amount of compensation paid to you during Calendar Year 2010 which was subject to Local Wage Tax or Earned Income Tax.

Box 19. Local income tax: Represents the total amount of Local Wage Tax or Earned Income Tax or Local Service Tax withheld during Calendar Year 2010.

If you have questions regarding your W-2 form, please contact the W-2 hotline at (215) 573-3277 or send an e-mail to W2Temp@exchange.upenn.edu.

You should have received, via the U.S. Postal Service, your Federal and State Income Tax Forms and related instructions for filing. Federal Tax forms are available at the Internal Revenue Service, 600 Arch Street, or by calling (800) TAX-FORM and online at www.irs.gov/formspubs/index.html. Pennsylvania Income Tax forms are available by calling (800) 362-2050. Federal and State forms are also available at many libraries and U.S. Post Offices.

The 2010 W-2 Form will also be available online at U@Penn. The web address is https://medley.isc-seo.upenn.edu/penn_portal/u@penn.php. You will need your PennKey and password to access the U@Penn portal. Once you have logged onto U@Penn and authenticated yourself, from the general tab, please click on My Tax Info under the Payroll and Tax section. From this point you will be directed to a Security notice on how to protect your confidential information. Once you have read this page and clicked the continue button you will be directed to a page which lists all of your tax forms that are available to view and/or print.

—Terri Pineiro, Director of Payroll and

Individual Disbursement Services

|